The Angi annual State of Home Spending report examines not only the projects completed by homeowners over the year but also how much they spent, the motivating forces behind their work, and their home improvement plans for next year and beyond.

Mallory Micetich, home care expert at Angi, tells KBB, “As millennials are still in their prime home-buying years, they were the top spending age cohort in 2022 and in 2023. In the last year, they spent an average of $16,136 on home improvement, repairs, and maintenance. The top three home improvement projects in 2023 were regular maintenance, followed by interior painting, and finally new appliance installation. Surprisingly, for the first time in 2 years, bathroom remodels dropped to fourth place.”

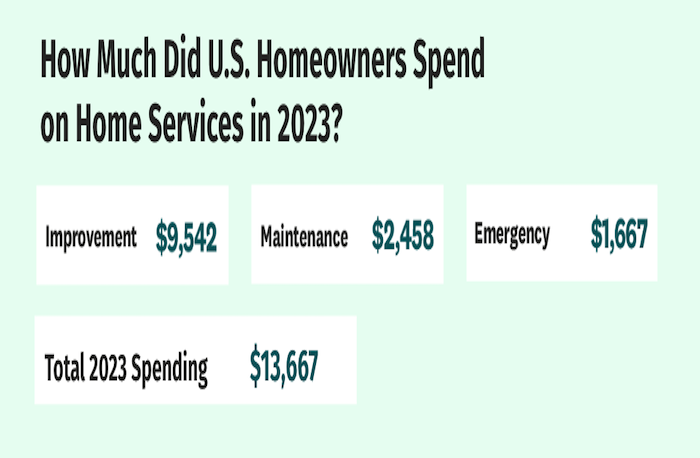

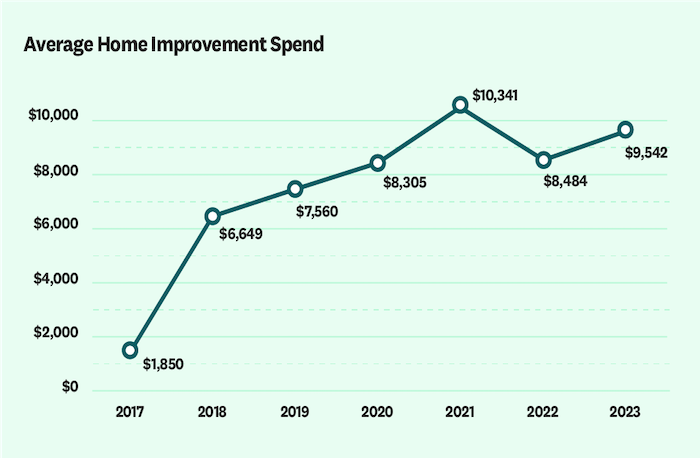

In 2023, the survey data shows consistently strong spending across all three categories of home services spending: improvement, maintenance and emergency repairs. On average, homeowners spent $13,667 across 11.1 projects this year. Spending levels rose slightly compared to 2022. Additionally, the overall trend of heightened spending on home improvement, which has been ongoing since 2020, remained consistent. This year, homeowners spent 51% more on home projects compared to home services spending in 2019.

Photo credit: Angi

Rising mortgage interest rates shaped homeowner perspectives and strategies for tackling home improvement projects this year. While the increased rates didn’t substantially change overall spending in 2023, they did affect the number of projects some homeowners took on this year. This year, 40% of homeowners reported taking on more home improvement work in response to rising interest rates that made moving or purchasing a new home less feasible. Looking forward, 30% of homeowners plan to undertake more work next year, motivated by rising mortgage interest rates. According to Angi’s data on the financing methods for this year’s home improvement projects, 46% of homeowners used cash from savings, while 20% used credit cards. Only 7% of homeowners refinanced an existing loan, and 5% used a HELOC loan.

When reviewing the data from 2020 to 2023, it becomes evident how the COVID-19 pandemic era reshaped the landscape of home improvement spending. These evolving motivations are highlighted in the trends, especially around project motivation, that emerged over the last four years in the Angi State of Home Spending report and surveys.

Photo credit: Angi

However, the report also notes some challenges from the last few years subside. For example, previous issues that prevented homeowners from completing projects, such as COVID-19-related disruptions and materials shortages, are no longer the primary causes of delays or postponements. For the first year since 2020, COVID-19 is not one of the most common reasons for incomplete projects, down 55% year-over-year. This year, the top two reasons for not completing work were budget-related: the total project costs or estimates were too high, and there was a need to prioritize emergency or unplanned projects. In another shift from previous years, homeowners who exceeded their time or budget on projects cited design choices as the core reason rather than material delays and shortages.

Lastly, the report notes how people felt about their homes and mortgages this year. There have been plenty of recent nationwide discussions about rising interest rates, and over the past few years, homebuyers have been operating in a market characterized by low inventory, high demand and elevated prices. Despite all of this, homeowners largely love their homes. This year, 51% of homeowners surveyed said they loved their home and their mortgage, 34% of those surveyed hated their mortgage but loved their homes, so a combined 85% of homeowners love their homes.

This love for our homes is helping to drive continued investment in them. It makes sense that our motivations for improving our homes have changed, and return on investment isn’t the sole factor guiding our decisions. We want to maintain our homes because we love them; we want to make our homes work for us as our lives and families change because we love them and we want to enjoy our homes more. In a year of transition, with often challenging news and uncertain signals from the economy and global stage, this positivity towards our homes and continued investment is a bright spot.

Photo credit: Angi

Key Takeaways from the Angi 2024 Report

1. Total spending across home improvement, maintenance, and emergency repairs increased 6% to $13,667 compared to 2022. However, the number of total projects declined 11% compared to 2022, with an average of 11.1 jobs per household. The growth in spending and the decline in total projects is likely due to the impact of inflation on the cost of home improvement projects or a change in the type of work done.

2. Home improvement spending was $9,542 per household in 2023. Homeowners who invested in home improvement did an average of 2.8 projects. Spending on home improvement increased 12%, but the average number of projects decreased from 3.2 to 2.8.

3. Home maintenance spending was $2,458 per household in 2023, and the average number of completed maintenance projects was 6.8. Homeowners completed an average of 3 landscaping jobs, 1.8 cleaning jobs, and 2 other maintenance projects.

4. Home emergency spending was $1,667 across 1.5 projects per household.

5. In 2023, the top three projects were regular maintenance (39%), like lawn care and gutter cleaning, followed by interior painting (30%) and new appliance installation (27%). Bathroom remodels dropped to fourth place at 26%, breaking a two-year streak in the top three most popular projects by a slim margin.

6. 2023 marks the fourth year that return on investment (ROI) as the primary motivator of home improvement spending has declined. Prior to the start of the COVID-19 pandemic, 2020, ROI was consistently a top motivating factor for doing work on our homes, but as the pandemic changed the way we think about our homes, it also changed what motivates American homeowners to take on improvements.

7. This year, the top motivator was to maintain the condition of my home (35%), followed by the desire to make their home better suited to lifestyle and needs (23%). In contrast, ROI was only 5% of American homeowners’ top motivation. What motivates us to do home improvement work has been changed by the pandemic, and even as many pre-pandemic activities returned in 2023, this pre-pandemic motivation did not.

8. Rising mortgage interest rates influenced how people thought about and took on home improvement projects this year. However, it did not meaningfully change home spending in 2023. This year, 40% of homeowners said they completed more home improvement work due to rising interest rates making moving or finding a new home less feasible. Looking forward, 30% of homeowners plan to make home improvement changes to their current home next year due to increased mortgage interest rates.

9. For the first year since 2020, COVID-19 is no longer one of the most common reasons for incomplete projects, down 55% year-over-year. Common issues (like permitting delays and materials shortages) in the home improvement space over the past three years are not impacting home improvement projects like in previous years. This year, homeowners who went over time or budget with projects cited design choices as the core reason, not material prices or shortages.

—By Leslie Clagett, KBB managing editor

Photo credit: Angi.com/MoMo Productions via Getty Images (top)