By Dianne M. Pogoda

In what could be considered a sign of optimism, the overall NKBA Pulse measurement of the impact of the coronavirus crisis fell by 0.1 point to 7.4, but more significant than the small change is that this directional trend has continued for five weeks.

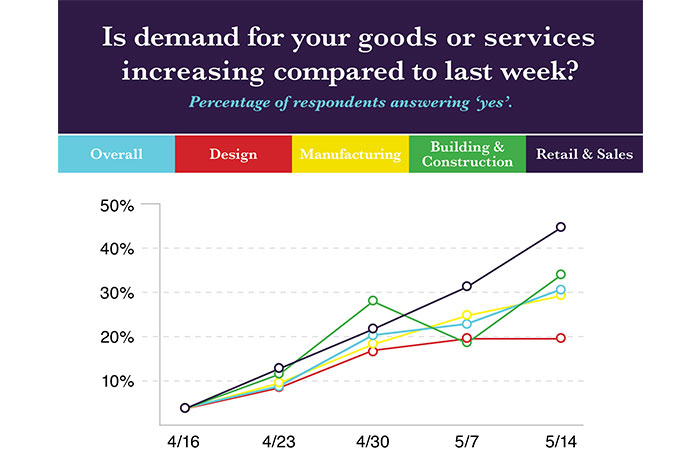

Also important is that more members report demand for their goods and services is rising. Overall, 30 percent of respondents said demand was increasing, up six points from 24 percent last week. The total saying demand was decreasing fell by five points, to 30 percent from 35 percent, and the number who said demand was stable was off by one point, to 40 percent from 41 percent.

NKBA’s weekly two-question survey measures the impact of the pandemic and resulting lockdown on members’ businesses on a scale of 1 (no impact) to 10 (significant impact), and whether demand for their goods and services is increasing, decreasing or staying the same. The survey tracks responses among designers, manufacturers, builders and retailers.

More than 850 members responded this week. Manufacturers rated the impact the same as the prior two weeks, at 7.3. Retailers, builders and designers said impact eased by 0.3 points from last week; Designers and retailers placed impact at 7.3, while builders ranked it at 7.4. Again this week, the most positive news came from reports about demand.

Retailers and building/construction pros reported the biggest swings in demand, up 10 percent and 12 percent, respectively. Among retailers, 41 percent said demand increased week-to-week, as did 33 percent of builders. This ties into the fact that some states have begun to allow stores and businesses to reopen, and allow builders and remodeling contractors to resume their projects in homes.

The same percentage of designers (21 percent) said demand was increasing as the week of May 7, while more (46 percent compared to 39 percent) said demand was stable. So, fewer designers said demand was decreasing: 33 percent compared to 40 percent the prior week.

The number of respondents reporting that demand was softening fell across all member categories. As more states rescind lockdown orders and businesses begin to have the opportunity for face-to-face contact with clients again, these numbers are expected to continue to improve. The most rapid recovery may be in the retail and building/construction sectors, as they have the closest contact with homeowners, but as the pipeline begins to fill up again, designers and manufacturers will catch up.