Since the housing market continues to face decreased mobility and high interest rates, the landscape for homebuyers and sellers is shifting in response. Today’s homeowners are evolving their priorities to combat affordability concerns, offering both challenges and opportunities for professionals in the kitchen and bath sector.

The Rise of First-Time Homebuyers in the Housing Market

The latest data from the Home Improvement Research Institute’s 2024 Recent Homebuyer and Seller Study reveals that first-time homebuyers now comprise 61% of the market, an 8% increase since 2022. This surge signals a shift toward younger buyers who may have waited a few years to enter the market and who are more focused on value-driven decisions. In particular, first-time buyers are prioritizing affordability, long-term value and functionality.

As first-time homebuyers grapple with housing affordability, many are opting for smaller homes. The average home size has decreased from 2,964 square feet in 2022 to 2,218 square feet in 2024. With buyers opting for fewer bedrooms and bathrooms, this could influence decisions on kitchen and bathroom renovations as they look to make the most of smaller interior spaces.

Given these trends, kitchen and bath professionals can focus on offering affordable, space-maximizing solutions. As younger homeowners opt for smaller interior spaces, there is a growing need for multifunctional, efficient designs in kitchens and bathrooms. HIRI data also suggests that more homeowners are seeking tailored solutions to meet their unique style and functional needs. Creative designs, floor plans and products that enhance functionality without compromising style will resonate with these buyers.

Renovation Priorities: Sellers vs. Buyers

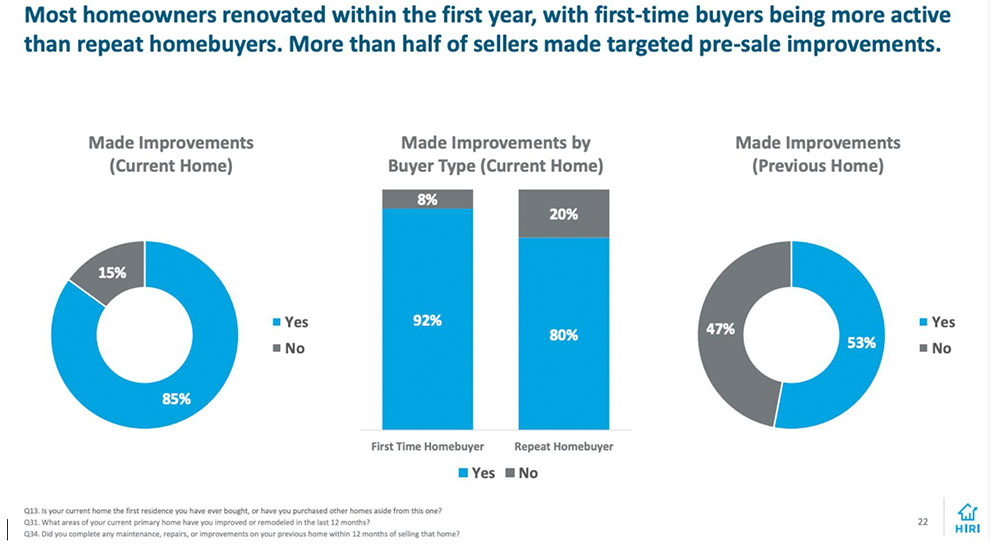

Another trend emerging from HIRI’s research into the housing market is the divergence between the priorities of homebuyers and sellers. While sellers are focused on making high-impact renovations to increase the resale value of their homes, buyers are concentrating on immediate post-purchase upgrades that add personal value to their new homes. HIRI’s 2024 study found that 53% of sellers made targeted pre-sale home improvements, with a focus on projects that improve curb appeal and increase interior appeal, such as kitchen and bathroom updates.

In contrast, buyers are focusing on functional upgrades within their first year of ownership, with kitchens, bathrooms and outdoor spaces being top priorities. While 85% of buyers made improvements within the first year of purchase, many are opting for smaller, more affordable improvements such as fresh paint and updated flooring, rather than full-scale remodels.

The divide between sellers and buyers presents a key opportunity for businesses in the kitchen and bath sector. While sellers may focus on projects with high return on investment, buyers are more likely to seek products that offer long-term durability, style and personal value. Designing solutions that cater to these distinct needs will position your brand to succeed in both markets.

DIY and Contractor Preferences: Who’s Doing the Work?

An interesting shift in the market is the evolving role of DIY. According to HIRI’s data, millennials are leading the charge in DIY home improvement, with 47% considering themselves at the intermediate skill level.

While DIY remains popular, many homeowners still prefer to hire professional contractors for larger, more complex projects. However, as affordability remains a top concern, this trade-off between DIY and professional help is likely to continue.

How can kitchen and bath businesses strike a balance? DIY-friendly designs that feature easy-to-install, budget-conscious products will appeal to millennials looking to enhance their kitchens and bathrooms on their own. At the same time, businesses should be prepared to recommend high-quality products that align with contractor-level skill sets for more substantial renovations.

The Road Ahead for Kitchen and Bath Professionals

A house is one of the most meaningful purchases a person will make in their lifetime. As we look ahead to 2025, first-time homebuyers will continue to shape demand for value-driven products in their quest to make their visions come true, and sellers will remain focused on ROI-driven projects to boost their home’s market appeal.

The data points to ample opportunity in the kitchen and bath sector, but success will depend on how well designers and other businesses can cater to the changing priorities of today’s homebuyers and sellers. Offering products that balance affordability, functionality and style will be key in capturing the hearts of this eager housing market.

Interested in more insights for the housing market? For industry researchers, marketing and product leaders, corporate executives and more, HIRI has the data to help guide strategic business decisions.

—By Dave King, Executive Director, Home Improvement Research Institute