Houzz Inc., the leading platform for home remodeling and design, released the Q2 2022 Houzz Renovation Barometer,* which found that construction businesses have tempered their positive outlook for Expected Business Activity in the second quarter of 2022 from last quarter’s peak, despite a strong first quarter performance. While architecture and design professionals remain confident about their business outlook, this has softened slightly, with expectations declining somewhat for project inquiries and new committed projects. Backlogs reached three months for construction professionals and nearly two months for architecture and design professionals.

“While business activity and the confidence in demand for construction and design services has been the strongest we’ve seen in the last four quarters, industry professionals are cautious about expected Q2 performance,” said Marine Sargsyan, Houzz staff economist. “Pros anticipate some impact on project inquiries due to inflation, supply chain delays and rising costs for materials, such as lumber, aluminum, and even gasoline. Lengthy backlogs persist into Q2 however, signaling continued home renovation and design activity.”

Q2 2022 Construction Sector Barometer

In the construction industry, build-only and design-build professionals are aligned on anticipated business performance although sentiments diverge on recent business activity for Q1 2022. While build-only remodelers report stronger activity compared to Q4 2021, design-build firms experienced a slight decrease in Q1 2022 activity compared with the previous quarter.

- The Expected Business Activity Indicator related to project inquiries and new committed projects decreased to 67 in Q2 (compared to 79 in Q1). Expectations for project inquiries declined significantly to 65 compared to 80 in Q1, and new committed projects are at 69 in Q2, down nine points relative to Q1.

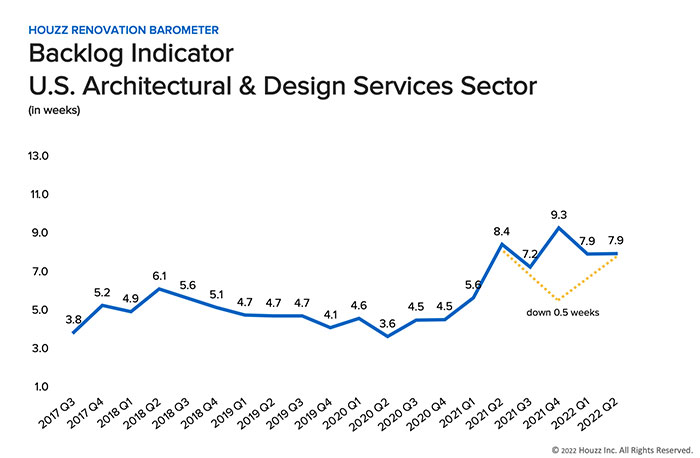

- The Project Backlog Indicator reached 12 weeks in Q2, which is the highest reported since 2017. Compared to the same period last year, backlogs are 2.7 weeks longer.

- The Recent Business Activity Indicator related to project inquiries and new committed projects rose significantly to 71 in Q1 (compared to 65 in Q4 2021). This is driven by a 4-point increase in project inquiries in Q1, relative to the previous quarter), and by a significant increase in new committed projects to 72 (64 points relative to Q4 2021).

Q2 2022 Architectural and Design Services Sector Barometer

Business performance expectations somewhat diverge among the architectural and design services subsectors. Interior designers expressed optimism for business in Q2, reporting higher expectations than last quarter for new committed projects.

Architects have tempered their outlook, anticipating decreases in project inquiries and new committed projects. Both groups report slower business activity in Q1 2022 compared to the previous quarter.

- The Expected Business Activity Indicator related to project inquiries and new committed projects declined to 65 in Q2. This decline is primarily driven by lowered expectations for project inquiries at 63 in Q2 (down 8 points relative to Q1), however, expectations for new committed projects increased to 68 in Q2 (compared to 67 in Q1).

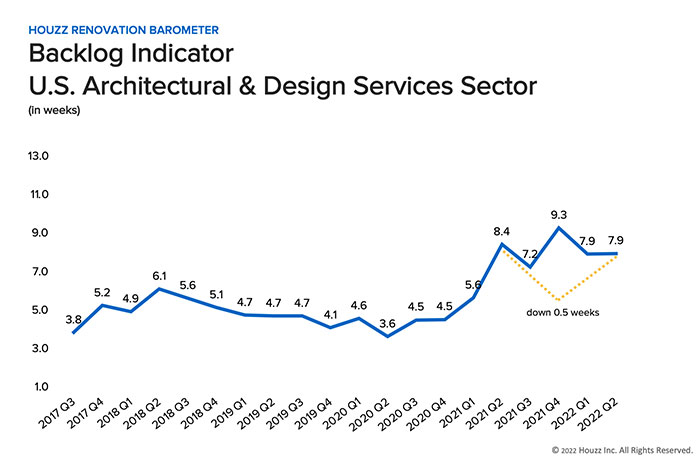

- The Project Backlog Indicator remains at 7.9 weeks in the beginning of Q2, which is consistent with the previous quarter, but slightly shorter than a year ago (8.4 weeks in Q2, 2021).

- The Recent Business Activity Indicator related to project inquiries and new committed projects declined to 63 in Q1 (compared to 65 in Q4 2021). This decline is the result of a drop in project inquiries to 62 (compared to 67 in Q4 2021) and an increase in new committed projects to 63 in Q1 (up one point from Q4 2021).

Regional Backlogs

Backlogs continue to grow across the industry, with the time before pros can begin work on a new, mid-sized project lengthening further across the country. In fact, wait times are the longest when compared to the start of any year since 2018.

Backlogs vary significantly by geography, but are longer in Q2 2022 than they were in Q2 2021 across all nine Census divisions in the U.S.

- For the construction sector, the East North Central division (including Michigan, Wisconsin, Illinois, Ohio and Indiana) has the longest backlog (13.8 weeks) driven primarily by design-build firms in the region (19.4 weeks), while build-only remodelers report 8.1 week wait times. Businesses in the East South Central division (which includes Kentucky, Tennessee, Mississippi, and Alabama) report 9.4 weeks of backlogs before they can begin a new project, the shortest wait time reported by construction firms among the nine Census divisions. Backlogs in the construction sector are similar to, or longer than, a year ago across all nine Census divisions.

- Backlogs also vary across all regional divisions among businesses in the architecture and design services sector. Businesses in the Middle Atlantic division (including New York, Pennsylvania, and New Jersey) reported 9.9 week backlogs, while the West North Central division (including North Dakota, South Dakota, Nebraska, Kansas, Minnesota, Iowa, and Missouri) showed much shorter backlogs at 6.2 weeks.

Backlogs reported by architects (12.4 weeks) in the Middle Atlantic division are the driving force for long wait times, whereas wait times to begin a new project with an interior designer in that area is only 5.7 weeks. Compared to the same quarter one year ago, backlogs for the architectural and design services sector are shorter across five of the nine Census divisions (East South Central, Mountain, New England, South Atlantic and West North Central divisions).

*The Houzz Renovation Barometer tracks residential renovation market expectations, project backlogs and recent activity among U.S. businesses in the construction sector and the architectural and design services sector.