Two new studies from Clever Real Estate discuss the true expenses of owning a home today.

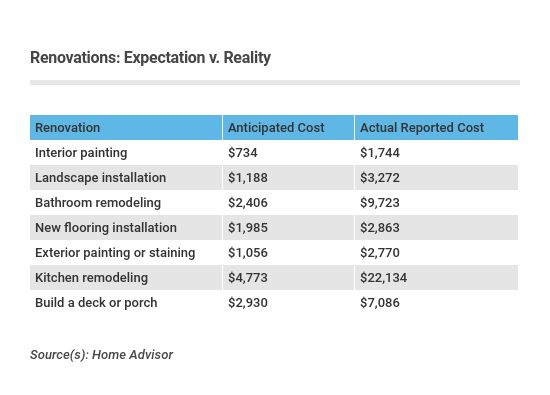

The first study shows that the average homeowner spends $2,676 on maintenance and repairs, $6,649 on home improvements, $2,600 on property taxes and $1,228 on homeowners insurance every year.

However, these numbers don’t tell the whole story.

Key Insights:

Key Insights:

- 59 percent of homeowners making renovations are using some combination of credit cards, personal loans and home equity loans to fund their projects.

- One in four homeowners have less than $500 saved for home repairs.

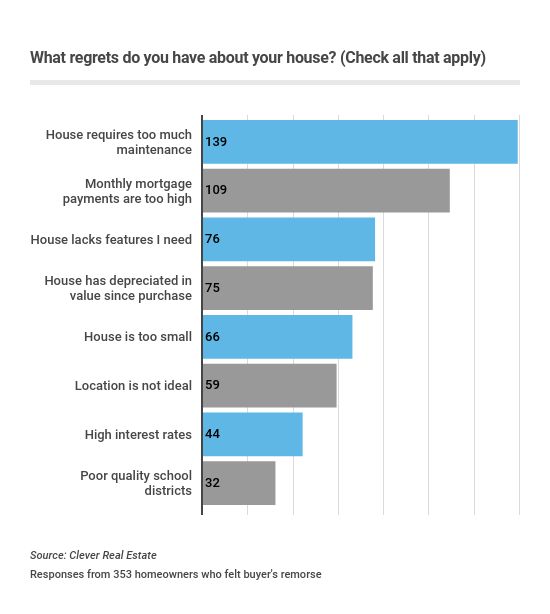

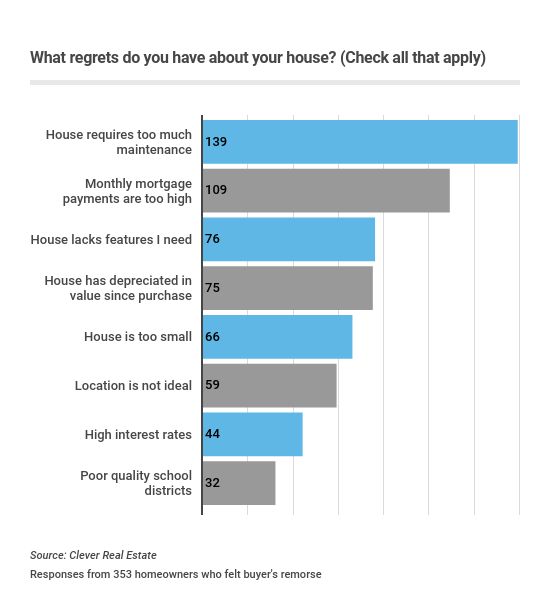

- In spite of the costs, 65 percent of homeowners said they’ve never felt home buyer’s remorse.

- Where you live matters: On average, New Jersey homeowners pay five times more in property taxes on a $206,000 home than they would if they lived in Alabama.

Millennial Insights:

Millennial Insights:

- Millennials are twice as likely to be stressed about homeownership than baby boomers.

- 67 percent of millennials put less than 20 percent down, leading to higher mortgage payments.

- Millennials are three times as likely to use a personal loan and twice as likely to use a credit card to finance their renovations than baby boomers.

- 43 percent of millennials were surprised by the cost of maintaining their homes.

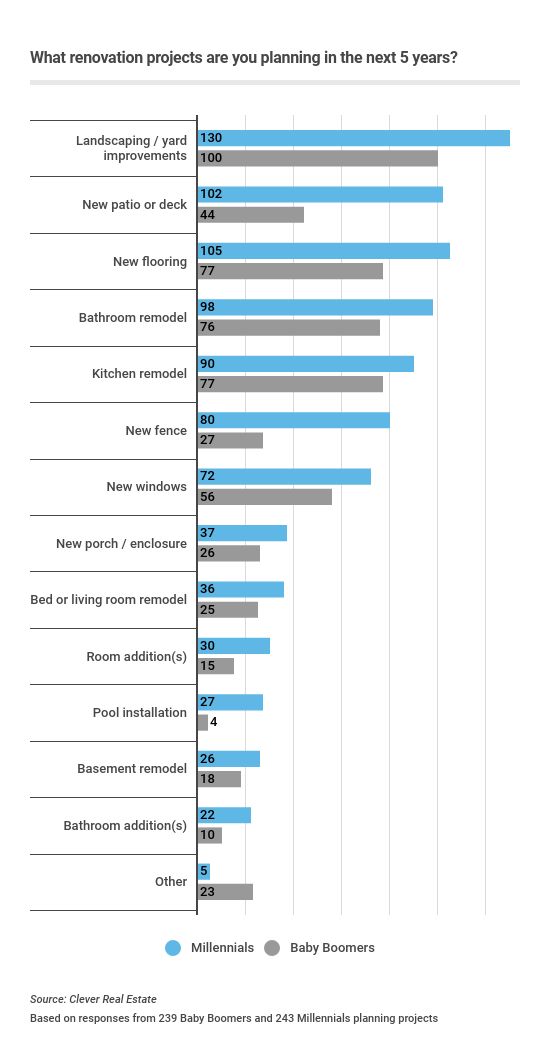

Almost every homeowner (75 percent) is planning renovations in the next five years, but millennials are planning 50 percent more renovations than Baby Boomers. Unfortunately, they’re also three times as likely to use a personal loan, and twice as likely to use a credit card to finance their renovations.

Combined with higher than average mortgage premiums due to putting less down, millennials are twice as likely to be stressed by homeownership. The primary reasons for millennial buyer’s remorse included high monthly mortgage payments (41 percent) and too much maintenance (33 percent).

We know from a previous study that millennials were more likely to buy a fixer-upper than other generations. One in four millennials made a homeowners insurance claim in the last 12 months, significantly more than old generations. It’s no surprise (to us) that 43 percent of millennials were surprised by the cost of maintaining their homes.

For more information on the studies, please visit:

- https://listwithclever.com/real-estate-blog/the-true-cost-of-homeownership/

- https://listwithclever.com/real-estate-blog/millennial-homeowner-study/