The Home Improvement Research Institute (HIRI), the nation’s leading resource for market research on the home improvement industry, announced findings from its latest U.S. Size of the Home Improvement Products Market report, including a revised downward forecast for market growth in 2025 due to prevailing macroeconomic challenges. The total home improvement market, which reached $574.3 billion last year, is now projected to grow by 3.4% in 2025, a reduction from the 5.0% growth projected in HIRI’s March outlook.

The updated forecast also reveals a notable divergence in anticipated growth rates between the professional and consumer markets, highlighting the distinct dynamics affecting these critical customer bases. Consumer market sales growth in current dollars is expected to grow by 2.6% in 2025, revised down from the 4.9% forecast in March. In contrast, professional market sales are projected to grow faster at 4.9% in 2025, in line with the March forecast.

“While our latest forecast reflects some near-term adjustments due to economic headwinds, the long-term picture for the home improvement market remains one of significant opportunity,” said Dave King, executive director of HIRI. “Looking out over the next five years through 2029, we anticipate a net gain in total market spend of roughly $300 billion in additional spend. While this growth is expected to be stronger toward the latter half of the period, it reflects that the underlying appetite and demand for home improvement projects are still robust.”

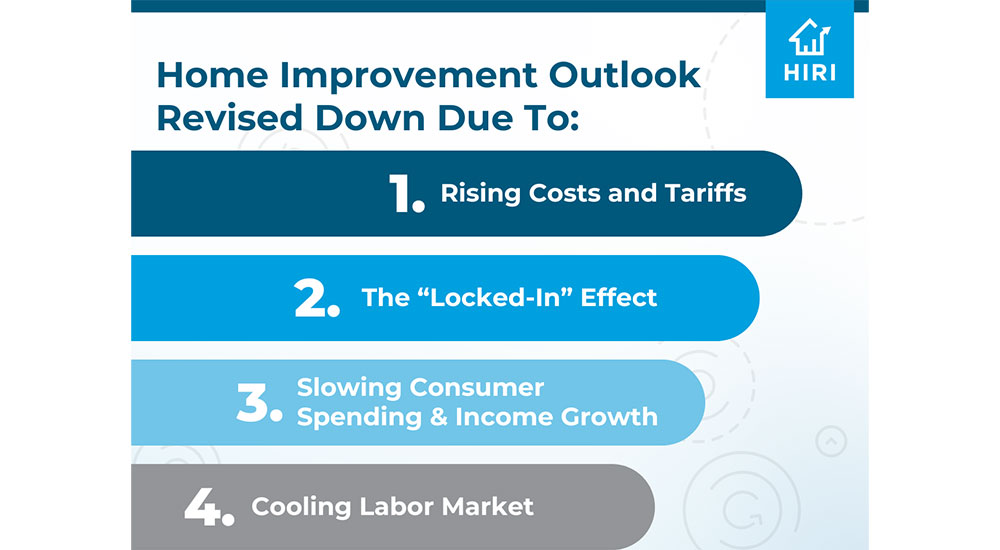

The research attributes the revised outlook to several specific economic headwinds:

- Rising Costs and Tariffs: The forecast incorporates the impact of anticipated new Section 232 tariffs on materials like copper and lumber (ranging from 10% to 25%), effective in late 2025. Additionally, IEEPA tariffs on imports from China (20%), Canada (25%) and Mexico (25%) are included. These factors, along with potential labor shortages, are expected to raise construction costs.

- Housing Market Challenges: The “locked-in effect,” where homeowners with low mortgage rates are hesitant to sell and buy at current high rates, is hindering existing home sales. Builders are also cutting prices and offering incentives on new homes due to high inventory. The forecast anticipates a slow rebound in existing home sales, climbing from 4.07 million sales in 2024 to 4.28 million in 2025 and 4.78 million in 2026, but housing starts are expected to remain relatively flat or dip slightly.

- Slowing Consumer Spending and Income Growth: While consumer spending grew in Q1, wage growth is slowing and prices are rising, leading to modest growth in real disposable income. Core inflation is also expected to spike in Q2 2025, reaching 3.9% for the year as tariff impacts arrive.

- Cooling Labor Market: While recent job reports show resilience, the forecast anticipates a cooling labor market with monthly payroll gains stalling in the second half of 2025 and the unemployment rate projected to peak at 5.0% by late 2026.