Houzz Inc. today released the Q1 2020 Houzz Renovation Barometer, which tracks residential renovation market expectations, project backlogs and recent activity among businesses in the construction sector and the architectural and design services sector in the U.S. The Barometer points to strong expectations for home renovation market activity in the first quarter of the year.

“Small businesses in the construction sector and architectural and design sector are heading into 2020 on a positive note, with expectations in line with last year and project backlogs already a few days longer than three months ago,” said Nino Sitchinava, Houzz principal economist. “Given the significant delays in 2019 due to weather, among other factors, businesses are optimistic about projects spilling over into the first half of 2020. Economic and political uncertainty, high product and material costs, and shortages of skilled labor continue to be the top cited concerns for 2020.”

Construction Sector

- The Expected Business Activity Indicator related to project inquiries and new committed projects remained steady at 74 in Q1.

- This is consistent in expectations for project inquiries at 78 and in new committed projects at 70.

- The Project Backlog Indicator increased to 5.4 weeks in Q1 relative to Q4 (5.2 weeks). That said, wait times are 1.3 weeks shorter than a year ago.

- The Recent Business Activity Indicator related to project inquiries and new committed projects increased to 65 in Q4 (up two points relative to Q3). Whileproject inquiries remained steady at 67 in Q4, new committed projects increased to 62 compared to Q3 (up two points).

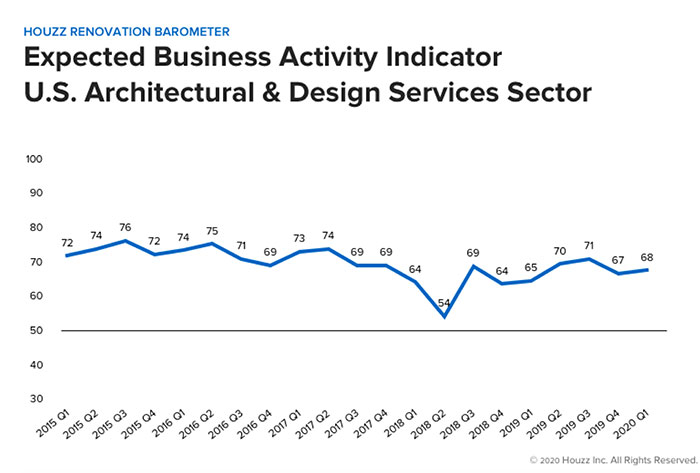

Architectural and Design Services Sector

- The Expected Business Activity Indicator related to project inquiries and new committed projects increased slightly to 68 in Q1 (up one point). Expectations remained steady at 67 for project inquiries and increased slightly to 68 for new committed projects (up one point in Q1).

- The Project Backlog Indicator increased to 4.6 weeks in Q1 relative to Q4 (4.1 weeks). Wait times are similar to one year ago.

- The Recent Business Activity Indicator related to project inquiries and new committed projects increased to 62 in Q4 (up five points relative to Q3). The increase is a result of an increase in project inquiries to 63 (up six points in Q4 relative to Q3) and an increase in new committed projects to 60 (up three points relative to Q3).